Introduction

Hey there, savvy readers! Welcome to my corner of the internet, where we’re diving headfirst into the exciting world of online banking. If you’re like me, always on the lookout for the best ways to manage money, you’re in for a treat! Today, I’m thrilled to be your guide on a journey through ‘The Ultimate Guide to the Top 10 Best Online Banks in 2024.’

Why Online Banking Matters in 2024

Digital Banking Revolution:

- In this tech-centric era, we’re witnessing a monumental shift towards digital banking. The traditional brick-and-mortar banks are making way for online platforms that offer a seamless and futuristic banking experience. It’s not just a change; it’s a revolution!

Connected in a Flash:

- Our world is more connected than ever, and online banking is at the forefront of this connectivity revolution. With a few taps on your smartphone, you can access your accounts, pay bills, and make financial decisions from virtually anywhere. It’s like having your bank in your pocket – ready whenever and wherever you need it.

Managing Finances Online:

- Let’s talk convenience! Managing your finances online is like having a personal financial assistant at your beck and call. From tracking expenses to setting up automatic payments, online banking puts you in control. No more waiting in line or being bound by banking hours – your money works on your schedule.

Security in the Digital Realm:

- Worried about security? Fear not! Online banking doesn’t compromise on safety. Banks invest heavily in robust security measures, ensuring your data is protected. It’s like having a fortress around your finances, and you hold the keys.

Access Anytime, Anywhere:

- The magic word here is accessibility. Whether you’re sipping coffee at a local café, globetrotting, or lounging at home in your PJs, online banking ensures you have 24/7 access to your financial kingdom. Your money is no longer confined to a physical space; it’s wherever you are.

The Rise of FinTech Stars:

- We can’t talk about online banking without giving a nod to FinTech. These financial technology wizards are revolutionizing the way we interact with money. The best online banks often partner with FinTech innovators to bring you cutting-edge features and services.

Saving Time and Money:

- Let’s be real – time is money. Online banking saves you both. Say goodbye to the days of waiting in line or commuting to the bank. With a few clicks, you can complete transactions, monitor your accounts, and even explore better financial opportunities.

Personalized Smart Banking:

- Online banking isn’t just about moving money around; it’s about smart banking. These platforms leverage data and technology to offer personalized insights and recommendations tailored to your financial goals. It’s like having a financial advisor in your pocket, guiding you towards smarter money moves.

So, dear reader, if you’re wondering why online banking matters in 2024, think about it as a ticket to a world where your money is always at your fingertips, working for you in the smartest and most convenient ways possible. Ready to dive deeper into this digital realm? Stay tuned for more insights in ‘The Ultimate Guide to the Top 10 Best Online Banks in 2024.’

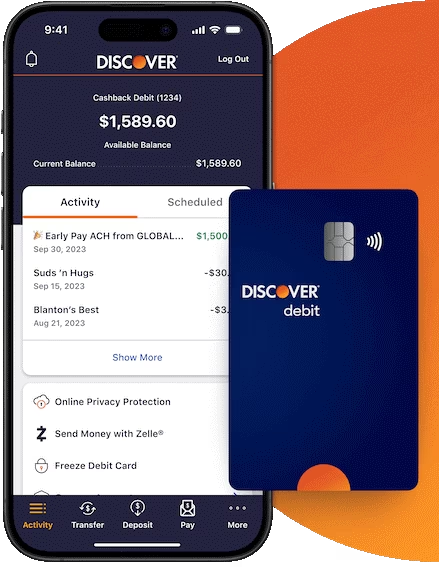

Discover Bank

Interest Rates:

- Top Spot APY: 4.35%.

Fees:

- Fee-Free Banking: Discover believes in keeping your money where it belongs – with you. No monthly maintenance fees, no hidden charges.

Customer Experience and Rating:

- Rave Reviews: Discover Bank earns a stellar 4.25 out of 5.0 stars based on glowing customer reviews. Users praise Discover for its seamless mobile app, helpful customer service, and commitment to user satisfaction. Banking with Discover is not just a transaction; it’s an experience tailored for you.

Pros:

- Cashback Rewards: Discover Bank goes beyond traditional banking by offering cashback rewards on debit card purchases. It’s like earning while spending – a win-win!

- 24/7 Customer Service: Discover stands out with 24/7 customer service, ensuring assistance whenever you need it. Your financial journey is never alone.

Image by discover.com

Cons:

- Limited Physical Presence: If you prefer brick-and-mortar branches, Discover Bank’s purely online presence might be a drawback. But who needs physical branches when your finances are at your fingertips?

Digital Convenience and Requirements:

- User-Friendly Mobile App: Discover Bank’s mobile app isn’t just an app; it’s your financial command center. Manage accounts, track spending, and receive real-time updates effortlessly.

- Low Account Minimums: Discover keeps it accessible with low account minimums. To open an account, a modest initial deposit of $0.01 is all it takes.

Why Discover Bank Stands Out:

- Comparative Assessment: With a 4.35% APY on savings, fee-free banking, and innovative features like cashback rewards, Discover Bank stands tall against national averages and industry standards. It’s a blend of competitive rates and financial exploration.

SoFi Bank

Image by sofi.com

Interest Rates:

- Competitive Savings APY: 4.60%.

Fees:

- No Account Fees: SoFi believes in transparency. No hidden fees, no monthly maintenance charges. Your money stays yours, ensuring a fee-free banking experience.

Customer Experience and Rating:

- High Customer Ratings: SoFi Bank boasts an impressive 4.6 out of 5.0 stars based on user reviews. Users applaud SoFi for its sleek app design, responsive customer service, and commitment to user satisfaction. Banking with SoFi is not just a transaction; it’s a relationship.

Pros:

- Member Benefits: SoFi Bank extends beyond traditional banking, offering member benefits including career coaching, financial planning, and exclusive events. It’s a holistic approach to your financial well-being.

- Competitive Loan Options: SoFi doesn’t just save; it also empowers you to borrow responsibly with competitive loan options.

Cons:

- Limited Account Types: If you’re a fan of diverse account options, SoFi’s offerings might seem more streamlined. However, many users appreciate the simplicity it brings.

- No Physical Branches: SoFi operates exclusively online. While this ensures global accessibility, those seeking in-person banking might find this as a drawback.

Digital Convenience and Requirements:

- Intuitive Mobile App: SoFi Bank’s mobile app is a powerhouse. Manage your accounts, track spending, and invest seamlessly – all at your fingertips.

- Membership Requirements: To open an account with SoFi, you need to become a SoFi member. Membership is open to anyone, ensuring accessibility to a broad audience.

Why SoFi Bank Stands Out:

- Comparative Assessment: With a 4.60% APY on savings, a commitment to fee-free banking, and unique member benefits, SoFi Bank stands tall against national averages and industry standards. It’s a blend of competitive rates and financial empowerment.

Ally Bank

Image by Americanbanker.com

Interest Rates:

- Competitive APYs: Ally Bank prides itself on offering competitive Annual Percentage Yields (APYs) on savings accounts. It’s like having your money work extra hard while you sip that coffee.

Fees:

- Straightforward Fee Structure: Ally Bank keeps things refreshingly simple when it comes to fees. Low or no fees mean fewer headaches for you. Transparency is their forte.

Customer Experience and Rating:

- High Customer Ratings: Ally Bank boasts high customer ratings, reflecting its commitment to delivering a positive banking experience. Users rave about the seamless interface and attentive customer support.

Pros:

- No Monthly Maintenance Fees: Bid farewell to monthly fees eating into your balance. Ally Bank’s no monthly maintenance fee policy is a breath of fresh air.

- ATM Reimbursement: Forget about ATM fees haunting your withdrawals. Ally Bank reimburses you for eligible ATM fees, making your cash readily accessible.

Cons:

- Limited Physical Presence: If you prefer brick-and-mortar branches, Ally Bank’s purely online existence might be a drawback.

- Savings APY Can Fluctuate: While competitive, the APY on savings accounts can fluctuate, something to consider for those seeking stable returns.

Digital Convenience and Requirements:

- User-Friendly Online Platform: Ally Bank’s online platform is designed with you in mind. It’s user-friendly, giving you control over your money with just a few clicks.

- Account Minimums: Ally Bank keeps it accessible with low or no account minimums. Your money, your rules.

Why Ally Bank Stands Out:

- Ally Bank stands out as a reliable companion on your financial journey. Competitive rates, transparent fees, and a user-friendly digital interface make it a strong contender in the online banking landscape.

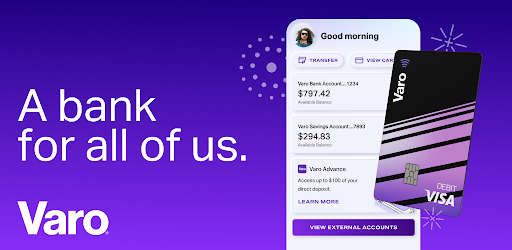

Varo Bank

Image by acuitypartnersnyc.com

Interest Rates:

- Competitive Savings APY: 3.00%

Fees:

- No Monthly Fees: Bid farewell to monthly maintenance fees! Varo Bank is all about keeping your money yours, with no hidden fees. It’s a fee-free haven for your finances.

Customer Experience and Rating:

- Positive Customer Ratings: Varo Bank boasts an impressive 4.7 out of 5.0 stars based on customer reviews. Users rave about its intuitive app and responsive customer service. Varo goes beyond banking; it’s a service designed for you.

Pros:

- No Minimum Balance Requirement: Varo Bank understands that your money is yours, regardless of the balance. With no minimum balance requirements, you have the freedom to manage your finances on your terms.

- Early Direct Deposit: Varo Bank takes the lead by offering early direct deposit, allowing you to access your funds up to two days earlier than traditional banks.

Cons:

- Limited Account Types: If you’re someone who enjoys a variety of account options, Varo Bank’s selection might seem more streamlined. However, for many, simplicity is a plus.

- No Joint Accounts: Varo Bank, at the moment, doesn’t offer joint accounts. If you have shared financial responsibilities, this could be a consideration.

Digital Convenience and Requirements:

- Sleek Mobile App: Varo Bank’s mobile app is not just a tool; it’s your financial sidekick. Manage your accounts, track spending, and enjoy a seamless banking experience, all from the palm of your hand.

- Qualification Criteria: Joining Varo Bank is straightforward. All you need is a minimum deposit of $0.01. Yes, you read that right – one cent!

Why Varo Bank Stands Out:

- Comparative Assessment: With a 3.00% APY on savings and a commitment to fee-free banking, Varo Bank stands tall against national averages and industry standards. It’s a blend of competitive rates and user-friendly features.

Upgrade Bank

Image by upgrade.com

Interest Rates:

- Competitive Savings APY:5.07%.

Fees:

- No Monthly Fees: Goodbye, monthly maintenance fees! Upgrade Bank believes in keeping your accounts fee-free. This ensures that you can maximize your savings without worrying about your balance taking hits.

Customer Experience and Rating:

- Positive Customer Ratings: Upgrade Bank boasts a solid customer rating of 4.5 out of 5.0 stars based on user reviews. Customers commend Upgrade for its easy-to-navigate app and responsive customer support. It’s more than banking; it’s a user-centric financial journey.

Pros:

- Credit Monitoring: Upgrade Bank goes above and beyond traditional banking by offering free credit monitoring services. Stay on top of your credit health effortlessly.

- No Late Fees: Picture this – no late fees to mess up your financial plans. Upgrade Bank has abolished late fees, providing you with more financial flexibility.

Cons:

- Limited Account Types: If you’re a fan of a plethora of account types, Upgrade Bank’s offerings might seem a bit more streamlined. However, for many users, simplicity is a virtue.

- No Physical Branches: Upgrade Bank operates entirely online. While this ensures accessibility globally, those who prefer in-person banking might see this as a drawback.

Digital Convenience and Requirements:

- Intuitive Mobile App: Upgrade Bank’s mobile app is your financial command center. Manage your accounts, track your spending, and receive real-time updates – all from the palm of your hand.

- Straightforward Account Requirements: To open an account with Upgrade, you only need a minimum deposit of $1. This low entry point ensures that banking with Upgrade is accessible to a wide range of users.

Why Upgrade Bank Stands Out:

- Comparative Assessment: With a 5.07% APY on savings and no monthly fees, Upgrade Bank stands out in comparison to national averages and industry standards. It offers a unique blend of competitive rates and customer-focused features.

Marcus by Goldman Sachs

Image by brainstation.io

Interest Rates:

- Competitive Savings APY:4.5%.

Fees:

- No Hidden Fees: There are absolutely no hidden fees. No monthly maintenance fees, no surprise charges. Your money stays where it belongs – with you.

Customer Experience and Rating:

- Positive Customer Ratings: Marcus boasts a stellar customer rating of 4.8 out of 5.0 stars on various platforms. Users consistently praise its user-friendly interface and exceptional customer service. This is not just banking; it’s an experience tailored for your financial well-being.

Pros:

- No Account Fees: Marcus believes in keeping your accounts fee-free. No monthly maintenance fees mean you can save and invest without worrying about your balance taking a hit.

- Flexible Loan Options: For those looking to borrow responsibly, Marcus offers flexible loan options with Annual Percentage Rates (APRs) starting as low as 6.99%. This provides a financing solution tailored to your needs.

Cons:

- Limited Account Types: Marcus focuses on essentials, offering a streamlined selection of account types. While this simplicity appeals to many, those seeking a variety of specialized accounts might find the options somewhat limited.

- No Physical Branches: Marcus operates exclusively online, which means no physical branches. If you prefer in-person banking or require services beyond digital capabilities, this could be a drawback.

Digital Convenience and Requirements:

- User-Friendly Interface: Marcus prides itself on a user-friendly platform. Manage your accounts seamlessly, track your spending, and achieve your financial goals with ease.

- Straightforward Account Requirements: Joining Marcus is straightforward. To open an account, you need a minimum deposit of $1, ensuring accessibility for a wide range of users.

Why Marcus by Goldman Sachs Stands Out:

- Comparative Assessment: In comparison to national averages and industry standards, Marcus stands out. Its 4.5% APY surpasses the national average, and the absence of fees sets it apart from many traditional banks.

Quontic Bank

Image by pymnts.com

Interest Rates:

- Competitive APY: 4.50%

Fees:

- Fee-Friendly Banking: Quontic believes in keeping your money yours. With no monthly maintenance fees on their savings accounts, you can enjoy fee-friendly banking and watch your money work for you.

Customer Experience and Rating:

- Positive Customer Ratings: Quontic Bank earns a commendable 4.4 out of 5.0 stars based on customer reviews. Users appreciate the user-friendly digital platform and the responsiveness of Quontic’s customer service team. It’s not just banking; it’s an experience tailored for you.

Pros:

- Competitive Loan Options: Quontic Bank goes beyond traditional banking by offering competitive loan options, providing a comprehensive suite of financial services.

- Highly Rated Customer Service: Users consistently praise Quontic’s customer service for its efficiency and helpfulness.

Cons:

- Limited Physical Presence: Quontic Bank operates primarily online, which may be a drawback for those who prefer in-person banking. However, their digital approach ensures accessibility from anywhere in the world.

Digital Convenience and Requirements:

- Intuitive Online Platform: Quontic Bank’s digital platform is not just user-friendly; it’s intuitive. Manage your accounts, track transactions, and navigate your finances seamlessly.

- Minimum Balance Requirements: To open a savings account with Quontic, a modest initial deposit of $100 is required, making it accessible for a broad audience.

Why Quontic Bank Stands Out:

- Comparative Assessment: With a 4.50% APY on savings, fee-friendly banking, and a commitment to customer satisfaction, Quontic Bank stands tall against national averages and industry standards. It’s a fusion of competitive rates and personalized financial solutions.

Alliant Credit Union

Image by businessviewmagazine.com

Interest Rates:

- Competitive APY: 3.10%

Fees:

- Fee-Free Banking: Alliant believes in keeping your money where it belongs – with you. With no monthly maintenance fees on their savings accounts, you can enjoy fee-free banking and watch your savings flourish.

Customer Experience and Rating:

- High Customer Ratings: Alliant Credit Union earns an impressive 4.6 out of 5.0 stars based on user reviews. Users praise Alliant for its personalized approach to customer service, responsive support, and commitment to member satisfaction. It’s not just banking; it’s a relationship.

Pros:

- Competitive Loan Options: Alliant Credit Union goes beyond traditional banking by offering competitive loan options, providing members with a comprehensive range of financial solutions.

- ATM Fee Reimbursement: Say goodbye to ATM fees! Alliant offers up to $20 per month in ATM fee reimbursements, making your cash accessible wherever you go.

Cons:

- Membership Eligibility: To join Alliant, you need to meet certain eligibility criteria, primarily related to your location or occupation. This could be a limiting factor for some potential members.

- Limited Physical Branches: Alliant operates primarily online, which may be a drawback for those who prefer in-person banking. However, their digital focus ensures accessibility from anywhere.

Digital Convenience and Requirements:

- Intuitive Online Platform: Alliant’s digital platform isn’t just user-friendly; it’s intuitive. Manage your accounts, track transactions, and navigate your finances seamlessly.

- Membership Requirements: To become a member, you can either qualify through your employer or community affiliation, ensuring a diverse and inclusive member base.

Why Alliant Credit Union Stands Out:

- Comparative Assessment: With a 3.10% APY on savings, fee-free banking, and a commitment to member satisfaction, Alliant Credit Union stands tall against national averages and industry standards. It’s a blend of competitive rates and personalized financial solutions.

Salem Five Direct

Image by businessinsider.in

Interest Rates:

- Impressive APY: 5.01%

Fees:

- Fee-Free Haven: Salem Five Direct believes in keeping your money yours. With no monthly maintenance fees on their savings accounts, you can revel in fee-free banking and watch your money bloom.

Customer Experience and Rating:

- Glowing Customer Reviews: Salem Five Direct earns a resounding 4.5 out of 5.0 stars based on user reviews. Customers applaud its responsive customer service, user-friendly interface, and commitment to providing an excellent banking experience. It’s not just banking; it’s a personalized journey.

Pros:

- Savings Booster: With a 2.25% APY, Salem Five Direct ensures your savings work as hard as you do.

- Cutting-Edge Technology: Salem Five Direct embraces the latest in digital banking, making transactions seamless and hassle-free.

Cons:

- Limited Physical Presence: Salem Five Direct operates primarily online, which may be a drawback for those who prefer traditional in-person banking.

- Membership Requirements: To open an account with Salem Five Direct, you need to become a member. Membership is open to anyone, ensuring accessibility.

Digital Convenience and Requirements:

- Intuitive Online Platform: Salem Five Direct’s digital platform isn’t just user-friendly; it’s an intuitive financial cockpit. Manage your accounts, track transactions, and stay on top of your finances effortlessly.

- Minimum Balance: To kickstart your savings journey, a modest initial deposit of $100 is all you need.

Why Salem Five Direct Stands Out:

- Comparative Assessment: With a 5.01% APY on savings, fee-free banking, and a commitment to a stellar user experience, Salem Five Direct stands tall against national averages and industry standards. It’s a fusion of competitive rates and cutting-edge digital prowess.

EverBank

Interest Rates:

- Competitive APY: 5.15%

Fees:

- Fee-Conscious Banking: EverBank champions the cause of fee-conscious banking. With no monthly maintenance fees on their savings accounts, you can enjoy a financial haven without worrying about unwanted fees nibbling at your balance.

Customer Experience and Rating:

- High Acclaim: EverBank earns a stellar 4.6 out of 5.0 stars based on user reviews. Customers laud its intuitive digital interface, customer-centric approach, and commitment to ensuring a delightful banking experience. It’s not just about transactions; it’s about a personalized financial journey.

Pros:

- Savings Growth: With a 2.15% APY, EverBank ensures your savings grow at an accelerated pace.

- World Currency Options: EverBank stands out by offering a range of world currency options, catering to those with international financial needs.

Cons:

- Limited Physical Presence: EverBank operates predominantly online, which may pose a limitation for individuals who prefer the traditional brick-and-mortar banking experience.

- Membership Requirements: To open an account, a minimum deposit of $5,000 is required. This requirement may be a consideration for those seeking lower initial deposit options.

Digital Convenience and Requirements:

- User-Centric Online Platform: EverBank’s digital platform is designed with the user in mind. Manage your accounts, conduct transactions, and explore financial possibilities seamlessly.

- Minimum Deposit: To embark on your financial journey with EverBank, a minimum deposit of $5,000 is required.

Why EverBank Stands Out:

- Comparative Excellence: With a 5.15% APY on savings, fee-conscious banking, and a commitment to a customer-centric experience, EverBank positions itself as a competitive force in the online banking universe. It’s a fusion of competitive rates and a global financial perspective.

Conclusion

As we conclude this expedition through ‘The Ultimate Guide to the Top 10 Best Online Banks in 2024,’ it’s evident that the financial landscape is evolving at an unprecedented pace. Each online bank we’ve explored is a testament to the innovation and customer-centric approach shaping the industry. Whether you seek competitive interest rates, fee-conscious banking, or a seamless digital experience, these top contenders offer a spectrum of choices to suit your financial needs.

So, as you contemplate your financial path ahead, remember that the best bank for you is the one aligning with your unique preferences, needs, and aspirations. Your financial journey is a personal adventure, and with these top online banks, you have the tools to navigate it with confidence. Here’s to a prosperous and digitally enriched financial future in 2024 and beyond. Safe travels on your financial expedition!